Are you interested in finding 'payment of bonus act 1965 case study'? Here you can find all of the details.

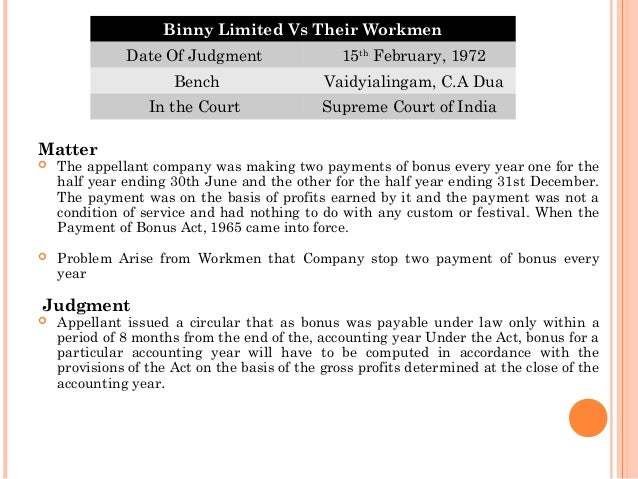

CASE STUDY ON THE PAYMENT OF Fillip ACT, 1965 12. Matter The appellant company was making two payments of bonus all year one for the half class ending 30th June and the some other for the fractional year ending 31st December.

Table of contents

- Payment of bonus act 1965 case study in 2021

- Sdepay view accounts

- Employer taxes on bonus pay

- Latest judgments on payment of bonus act

- Section 9 of payment of bonus act, 1965

- Payment of bonus act, 1965 mba notes

- Payment of bonus act 2015

- The payment of bonus act, 1965 does not apply to employees employed by

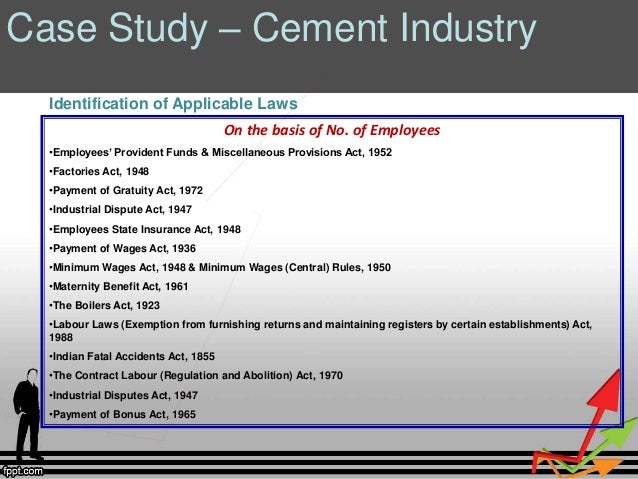

Payment of bonus act 1965 case study in 2021

This picture illustrates payment of bonus act 1965 case study.

This picture illustrates payment of bonus act 1965 case study.

Sdepay view accounts

This image illustrates Sdepay view accounts.

This image illustrates Sdepay view accounts.

Employer taxes on bonus pay

This image illustrates Employer taxes on bonus pay.

This image illustrates Employer taxes on bonus pay.

Latest judgments on payment of bonus act

This picture representes Latest judgments on payment of bonus act.

This picture representes Latest judgments on payment of bonus act.

Section 9 of payment of bonus act, 1965

This image shows Section 9 of payment of bonus act, 1965.

This image shows Section 9 of payment of bonus act, 1965.

Payment of bonus act, 1965 mba notes

This picture demonstrates Payment of bonus act, 1965 mba notes.

This picture demonstrates Payment of bonus act, 1965 mba notes.

Payment of bonus act 2015

This image demonstrates Payment of bonus act 2015.

This image demonstrates Payment of bonus act 2015.

The payment of bonus act, 1965 does not apply to employees employed by

This picture demonstrates The payment of bonus act, 1965 does not apply to employees employed by.

This picture demonstrates The payment of bonus act, 1965 does not apply to employees employed by.

Can a workman claim ex gratia under Bonus Act?

• Ex gratia not being bonus under the Payment of Bonus Act can not be claimed by the workman as a matter of right since it is paid at the will of the employer. Godrej Soaps Ltd. v. Baban Baburao Nemane, (2003) 98 FLR 569: 2003 LLR 1065: 2003-111 LLJ 1036 (Born He).

When did the payment of Bonus Act 1965 take place?

Matter The appellant company was making two payments of bonus every year one for the half year ending 30th June and the other for the half year ending 31st December. The payment was on the basis of profits earned by it and the payment was not a condition of service and had nothing to do with any custom or festival.

Can a lay off be considered as a bonus?

• Lay-off compensation paid to the employees will form part of 'wages' under the Act for determination of bonus payable to the employees. 1. P.K. Mohankumar v.

Can a reinstated employee claim a bonus linked to productivity?

• Employee cannot claim bonus linked with productivity unless there is a special agreement. S,G. Pharmaceuticals v. Sarabhai Chemical Staff Association, (1999) 1 CLR404: 1999 LLR 291 (Guj HC). • A reinstated employee will not entitled to bonus for the period when he did not work because of his illegal termination. Ahmed Hussain v.

Last Update: Oct 2021